Business Checking Account

Business Checking with a Side of Southern Hospitality

Around here, we do business with a handshake and a smile. Get the perks you need with the personal touch you deserve because banking should feel like home.

VIP Business Checking

Tailored for businesses with higher balances, offering exclusive interest rates and VIP treatment.

- Only $100 minimum opening deposit.

- Avoid a $25 monthly maintenance fee by maintaining a $10,000 minimum daily balance.

- 250 free transactions per statement cycle, including credits, withdrawals, electronic debits, checks and deposited items. If more than 250, a $0.45 fee per additional transaction is assessed, interest rates are tiered and competitive rate of interest paid.

- Free Monthly Statement

- Competitive rate of interest paid; interest is compounded and credited monthly.

- Variable interest rate (rate may change at any time).

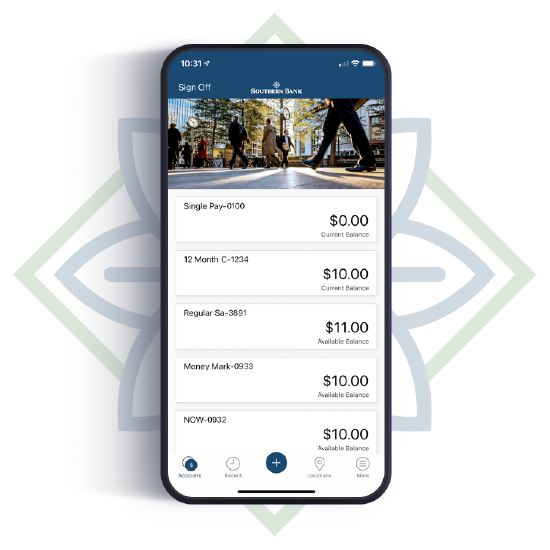

- Free Online Banking

- Free Mobile Banking with Mobile Deposit

- Free Text Banking

- Free Debit Card

- Free Telephone Banking

- Free Check Images with Monthly Statement (Fronts of debits)

Essential Business Checking

Designed for small businesses and nonprofits with low monthly account activity.

- Only $100 minimum opening deposit.

- Avoid a $10 monthly maintenance fee by maintaining a $500 minimum daily balance.

- 250 free transactions per statement cycle, including credits, withdrawals, electronic debits, checks and deposited items. If more than 250, a $0.45 fee per additional transaction is assessed.

- Free Online Banking

- Free Mobile Banking with Mobile Deposit

- Free Text Banking

- Free Debit Card

- Free Telephone Banking

- Free Check Images with Monthly Statement (Fronts of debits)

Business Interest Checking

Designed for businesses with low monthly account activity that want to earn interest on collected balances.

- Only $100 minimum opening deposit.

- Avoid a $15 monthly maintenance fee by maintaining a $2,500 minimum daily balance.

- 250 free transactions per statement cycle, including credits, withdrawals, electronic debits, checks and deposited items. If more than 250, a $0.45 fee per additional transaction is assessed.

- Competitive rate of interest paid; interest is compounded and credited monthly.

- Variable interest rate (rate may change at any time).

- Free Online Banking

- Free Mobile Banking with Mobile Deposit

- Free Text Banking

- Free Debit Card

- Free Telephone Banking

- Free Check Images with Monthly Statement (Fronts of debits)

Commercial Checking

Designed for businesses with high monthly activity that want to offset fees with an earnings allowance.

- Only $100 minimum opening deposit.

- $15 monthly maintenance fee.

- Transaction fees; $0.40 for each credit, $0.19 for each debit and $0.12 for each deposited item.

- Earnings allowance can reduce or eliminate monthly service and transaction fees.

- Free Online Banking

- Free Mobile Banking with Mobile Deposit

- Free Text Banking

- Free Debit Card

- Free Telephone Banking

- Free Check Images with Monthly Statement (Fronts of debits)

Additional Services

- Free Basic Online Banking

- Free Mobile Banking

- Free Debit Card

- Free Check Images included with Monthly Statement (Fronts Only)

- Free Night Drop

- Customer pays for checks/deposit slips

Here to Help You Succeed