Business Savings

& Money Market Account

Find the right business savings account

Business banking is personal at The Southern Bank. And we have a variety of ways to help your business save more, and earn more, on your assets.

Southern Business Savings

Designed for businesses that want to earn interest and can easily deposit or withdraw money.

- Only $100 minimum opening deposit.

- Avoid a $12 monthly maintenance fee by maintaining a $500 minimum daily balance.

- Competitive rate of interest paid on all balances; interest is compounded and credited quarterly.

- Variable interest rate (rate may change at any time).

- A $5 fee will be imposed for every withdrawal over six (6) in the statement cycle.

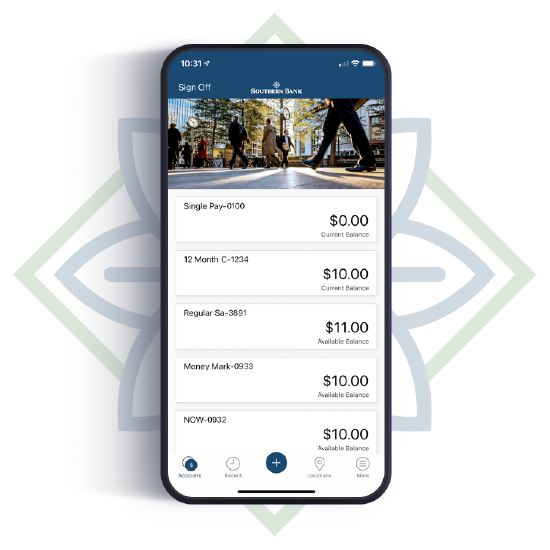

- Free Online Banking

- Free Mobile Banking with Mobile Deposit

- Free Text Banking

- Free Telephone Banking

Southern Business Money Market

Designed for businesses that want to earn a higher rate of interest with the convenience of writing checks.

- Only $100 minimum opening deposit.

- Avoid a $15 monthly maintenance fee by maintaining a $2,500 minimum daily balance.

- Interest rates are tiered, and interest is compounded and credited monthly.

- Variable interest rate (rate may change at any time)

- A $5 fee will be imposed for every withdrawal over six (6) in the statement cycle.

- Free Online Banking

- Free Mobile Banking with Mobile Deposit

- Free Text Banking

- Free Debit Card

- Free Telephone Banking

- Free Check Images with Monthly Statement (Fronts of debits)

Additional Services

- Free Basic Online Banking

- Free Mobile Banking

- Free Debit Card

- Free Check Images included with monthly Statement (Fronts Only)

- Free Night Drop

- Customer pays for checks/deposit slips

Here to Help You Succeed